Art Galleries and the Rise of the Online Marketplace

A deep dive into art gallery strategies and how the pandemic is shaping their future.

Wander into an art gallery, and you’ll find all sorts of people—budding local artists admiring their inspirations, or curious tourists warily eying the guards while trying to take a photo. From London’s Saatchi to Lagos’ Nike Art Gallery, thousands walk these halls daily— all for the pieces on the walls.

But the masterpieces won’t remain on those walls forever. Unlike museums, the works are for sale, lying in wait for a dealer or collector to purchase a piece that catches their eye. Art, after all, is also a business.

To the average onlooker, this industry possesses some level of intrigue, driven in part by pop culture — between heist films and popularized auctions of famous works, galleries have often been associated with inaccessible pomp and wealth. This assumption isn’t wholly incorrect —this industry thrives partly on social connection and high wealth, shrouding the art world in an air of exclusivity where wealthy buyers and sellers dominate a market that revolves around a small group of artists. ArtNet revealed that only 25 artists are responsible for almost half of the sales made in the global art market. To understand why only a few attain astronomical success, it's important to understand the strategies behind the industry's movers and shakers.

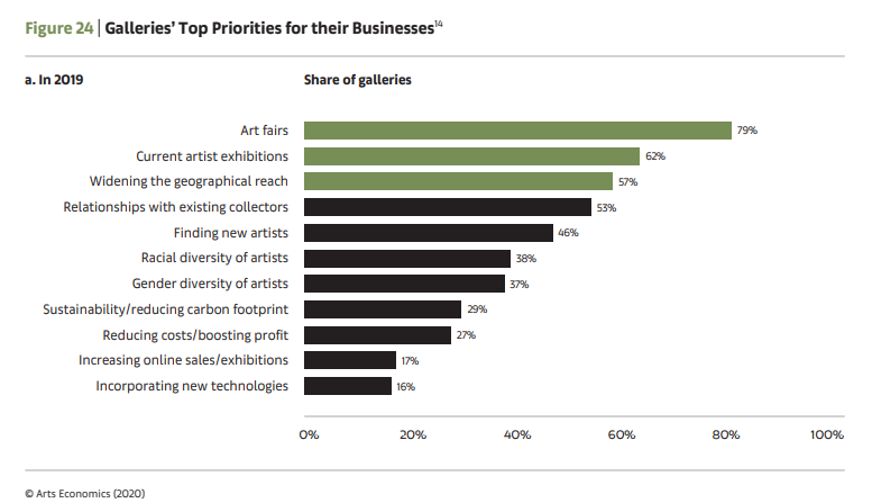

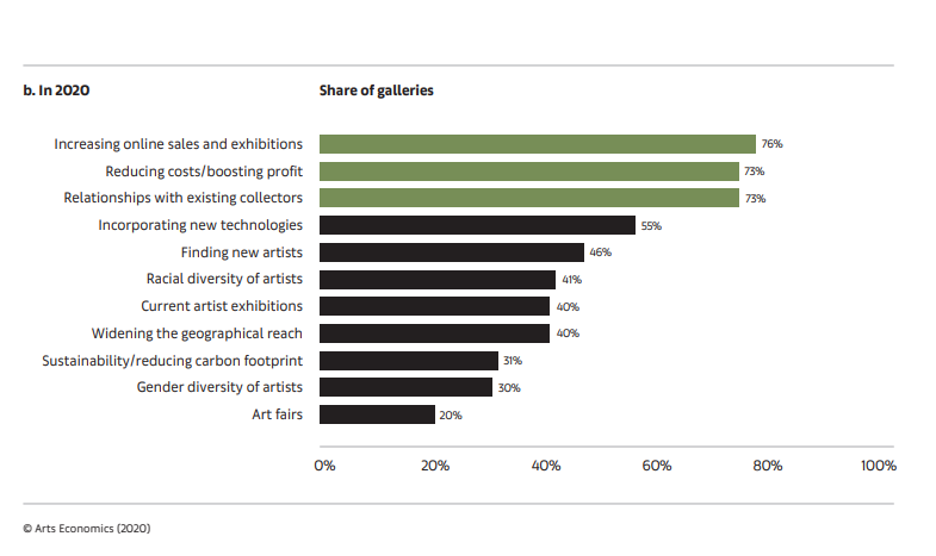

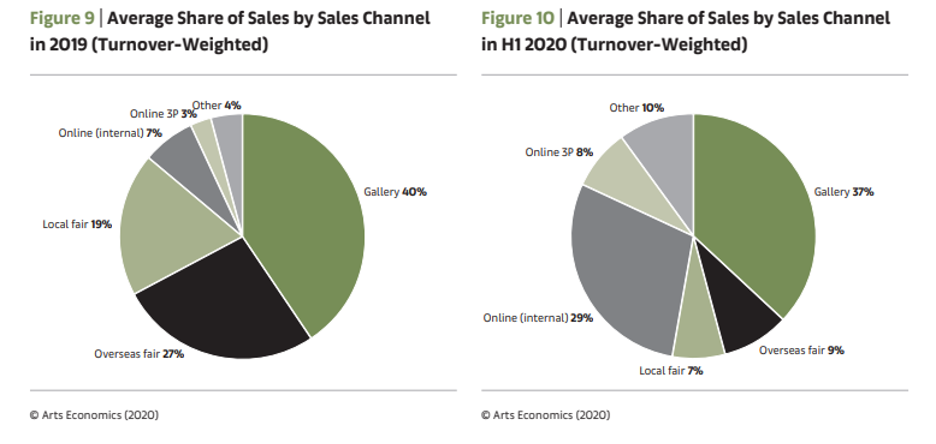

Imagine crowds of industry VIPs and art enthusiasts coming together to buy art, network with each other, and make deals— all under the same roof. Such is the way of the art fair. Thousands of them occur each year, all over the world, whether as local festivities like Art x Lagos or international events like Art Basel— the mother of all art fairs. These events are integral to galleries; on average, 46% of gallery sales come from these events. But the sales come at a high cost — 29% of expenditure to be exact — making it the single highest cost component. In addition to the exorbitant costs, these events pose a logistical and environmental nightmare. As sustainability becomes more of a concern to businesses, galleries are looking to reduce the number of fairs they attend or stick to attending local fairs. Despite its inconveniences, most galleries reported that art fairs remained a priority, followed by current artist exhibitions and increasing engagement.

Then the pandemic struck.

According to Art Basel X UBS’s yearly Art Market Report, the global market dropped from $64.4 billion to $50.1 billion in sales, a low unheard of since 2009. Between lockdowns and layoffs, many galleries struggled, especially smaller galleries at the lower end of the market. The growing crisis forced most galleries to switch tactics — art fairs reportedly became a priority for only 20% of galleries, while 76% placed higher importance on sales. In essence, most galleries abandoned conquering new markets in favor of maintaining profits and keeping their business afloat.

With everyone sticking to existing clients, new entrants — both artists and galleries — could have a tough time breaking into the market. The lucky few that manage such a feat will have established, well-connected players to contend with. So, while playing it safe will help some galleries, it could also reinforce the exclusivity of the industry.

Not if the Internet has anything to say about it. While the current gallery model relies on social connections and in-person interactions, developments in online channels could level the playing field. In a way, the pandemic forced the industry’s hand; 61% of art fairs were canceled, creating a need to find business elsewhere. But as art sales plummeted, online sales took off.

The pandemic made online platforms a necessity, not an option. Artsy reported that the average gallery’s marketing budget for social media increased by 92% from 2019, partly because online channels replaced art fairs as sales channels. Considering that social media is such a visual medium, it makes for the perfect tool for art galleries to market their wares, and to a larger audience. 73% of galleries say that at least half of their collectors via social media were new customers.

Over 60% of galleries increased spending on internet infrastructure by enhancing their online content and presence and establishing online viewing rooms, and it paid off. Online sales for galleries showed a sizeable increase, going from 10% of total sales to 37%. In the past 7 years, online art market sales have increased, but at a slower rate than other industries. That's no surprise — anyone would think twice before purchasing a million-dollar painting they've never seen in person. And gallerists have expressed that though online platforms have become increasingly relevant and useful, nothing beats the allure of networking with other patrons and dealers in fairs, and appraising works up close.

There are obvious advantages to investing in online sales and marketing strategies, including a wider reach, access to a younger demographic, and lower operating costs. But like many industries, the art world at its core revolves around human interaction; the thrill of fairs, close relationships with dealers and gallerists, and seeing art exhibitions in person. With the end of the pandemic potentially looming closer, many in the art industry are itching to resume business as usual and make up for lost time and connections.

A new question remains: how many of the online infrastructures will remain as strategic channels for galleries when galleries re-open their doors in the post-pandemic future? Will online sales and marketing strategies retain their value, or be relegated to secondary importance? Like with the paintings on the gallery walls, only time will tell.